Current

Financial Health in Older Americans

In this qualitative research study, The Financial Health Network aimed to understand the financial advising needs of LMI older adults and to identify design features that providers can implement to support LMI older adults in successfully adopting and using digital financial advising tools as they approach retirement.

NBER Graduate Student Research Fellows

With the generous support of ICMM, the NBER is a graduate student fellowship program that supports emerging researchers who are studying consumer financial behavior, with an emphasis on the choices and decisions of low- to moderate-income (LMI) households. The program provides up to two years of research support for outstanding doctoral students in North American economics and finance Ph.D. programs. ICMM will award up to 10 research fellows with this grant.

Seeded Investments for HBCU Students

ICMM has recently partnered with Stackwell to provide seeded investment funding to HBCU students across the United States. In combination with financial education, Stackwell aims to help young adults learn how to navigate the investment landscape and develop positive habits of adding to their investments over time. ICMM has contributed to the funding of 100 students with an initial seeded investment of $1,000 per student.

Researching Financial Wellbeing in Vulnerable Groups

Partners: NC State University, Stanford University, University of Pennsylvania

In the summer of 2019, the Institute of Consumer Money Management awarded a four-year grant to North Carolina State University with Robert Clark as the Principal Investigator. The research team included co-PIs Annamaria Lusardi of Stanford University and Olivia S. Mitchell of the University of Pennsylvania. The proposed research consisted of two nationally representative surveys of individuals aged 45 to 75, examination of five important policy areas, and a capstone conference.

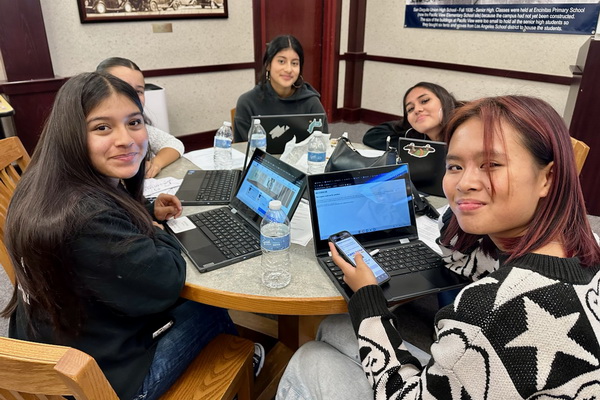

Young Enterprising Women Mentoring Program

The Young Enterprising Women program is a national program that brings together women leaders, entrepreneurs, and STEAM professionals within local communities to teach high school girls from intercity and underserved areas about financial literacy and wellbeing, and becoming an entrepreneur or STEAM professional.

Financial Education for NC Employees

The purpose of this project is to provide free financial education to employees in North Carolina, starting with those working at NCSU. This project began in early 2025 and will include 3 classes per group teaching the essentials of financial management, such as budgeting, saving, and investment.

Optimizing Tax Expenditures for Retirement and Health

The Retirement Security Project at the Brookings Institute was recently awarded a grant by ICMM to analyze how U.S. tax policies on retirement savings and healthcare expenses impact federal revenue and household wellbeing, with a focus on equitable, efficient reforms benefiting low- to moderate-income (LMI) families.

The project will assess two separate but interrelated research areas: 1) Trade-offs in Subsidizing Out-of-pocket Medical Expenses, and 2) Distributional Implications of Limiting Retirement Savings Subsidies

Measuring the Economic Burden on Unpaid Caregivers

The Retirement Security Project at the Brookings Institute was recently awarded a grant by ICMM to measure the economic burden of unpaid caregivers around the United States. One of the biggest financial risks people face in retirement is the need for long-term care, and many people rely on unpaid care provided by spouses, children, and other relatives or friends when they face this need. The Bureau of Labor Statistics estimates that around 37 million people, or 14 percent of the population, provide unpaid eldercare in the United States annually

This work will seek to quantify unpaid caregivers’ willingness to pay (WTP) for reductions in the number of care hours they provide using a discrete choice experiment.

Emergency Savings Accounts and Financial Resilience

In 2025, ICMM brought together the Center for Retirement Research (CRR) at Boston College and the National Foundation for Credit Counseling (NFCC) to conduct a year-long research project. This research evaluates how combining debt repayment with emergency savings in NFCC’s “WealthBuilder” savings program (a cornerstone of their Life Beyond Debt program) improves household financial resilience and informs national consumer finance policy.

The research generates critical evidence on how to help financially vulnerable households improve both their short-term stability and long-term financial health.

Completed

NOVA Financial Lab

With a grant from the Institute of Consumer Management, PBS and the Center for Advanced Hindsight developed free, online games for the popular NOVA Labs platform for teens informed by the latest behavioral insights in the domain of financial decision-making. Think of it as a fun place to practice managing a budget.

Lit Review: The Effect of Physical and Mental Health on Financial Wellbeing

The Institute of Consumer Money Management (ICMM) funded a study to explore the Link between Physical and Mental Health and Financial Wellbeing. A new literature review titled “Literature Review on the Effect of Physical and Mental Health on Financial Wellbeing” has been published by a team of economists at Montana State University, providing a comprehensive summary of the documented effects of health on finances in the United States.

Using Machine Learning to Improve DMP

In partnership with Consumer Education Services and American Financial Solutions, ICMM conducted a project to evaluate the effect of machine learning models on client DMP outcomes. Project Objectives: 1) Provide credit counseling agencies with information about the status of their debt management programs. 2) Provide individual-level feedback on DMP clients. 3) Recommend interventions to improve DMP results. 4) Analyze the impact of interventions.

Can Behavioral Interventions Improve Debt Management Plan Outcomes?

ICMM funded a research project with Dr. Jeremy Burke, from the University of Southern California, Center for Economic and Social Research to test the effects of behavioral interventions on debt management plan (DMP) dropout rates. They find evidence that simple, carefully designed behavioral interventions can meaningfully reduce DMP dropout and improve client debt reduction outcomes.

Dissertation: Estimating School Choice Effects Using Centralized School Assignment

This dissertation, partially funded by ICMM and written by Siyan Liu (currently at Boston College’s Center for Retirement Research) provides empirical evidence on estimating the treatment effects of school choice programs using quasi- experimental data. Chapter 1 implements the new econometric method in the context of the magnet school program in Wake County, North Carolina. Chapter 2 gives an in-depth analysis of the assignment propensity scores used in Chapter 1. Using simulation data, this chapter proposes two measures for the “ideal” propensity score distribution for the identification of treatment effects.

Evaluating Financial Wellbeing in U.S. Households

In the summer of 2019, the Institute of Consumer Money Management awarded a four-year grant to North Carolina State University with Robert Clark as the Principal Investigator. The research team included co-PIs Annamaria Lusardi of Stanford University and Olivia S. Mitchell of the University of Pennsylvania. The proposed research for this initial phase consisted of two nationally representative surveys of individuals aged 45 to 75, examination of five important policy areas, and a capstone conference. Phase 1 was completed in 2023.