Helping Americans Tackle Debt and Build Savings

ICMM is honored to partner with NFCC and the Center for Retirement Research to support research that can guide impactful interventions and policy changes, advancing our mission to improve financial wellbeing — particularly for low- to moderate-income (LMI) households.

On June 30, 2025, the National Foundation for Credit Counseling (NFCC) announced the launch of its innovative Life Beyond Debt program — a groundbreaking initiative that helps individuals reduce debt and build emergency savings at the same time.

For many Americans, the lack of even a modest financial cushion leaves them vulnerable to unexpected expenses and financial stress. According to NFCC’s 2025 Financial Literacy and Preparedness Survey (see also the Key Insights Report [PDF]), nearly one-third of U.S. adults have no savings outside of retirement accounts— a key marker of financial fragility.

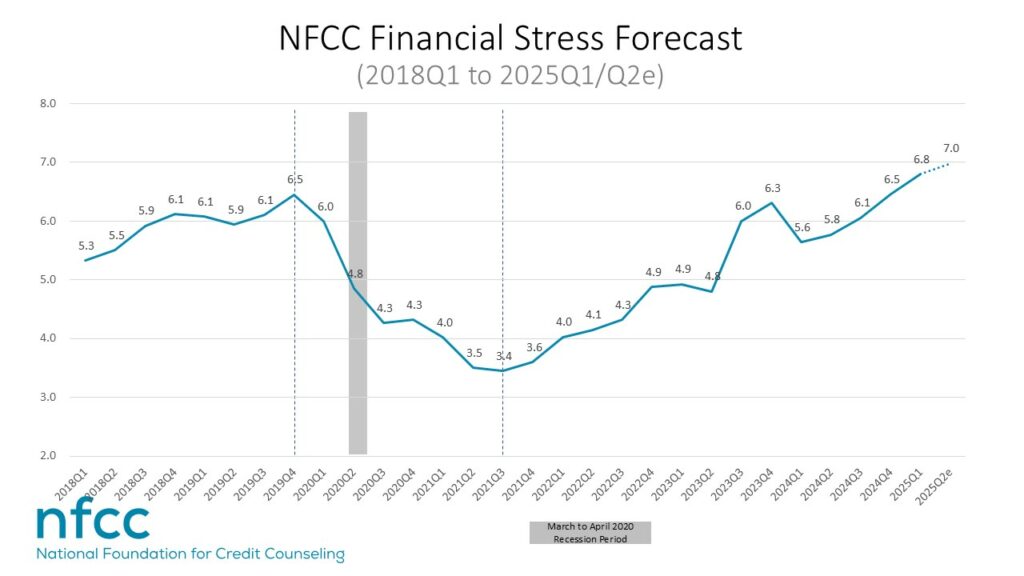

Further underscoring the urgency of addressing these challenges, the NFCC’s own Financial Stress Forecast, a metric developed with the guidance of ICMM board member Dr. Tara Kenyon, indicates that consumer financial strain has risen to pre-pandemic levels — registering at 6.8 in Q1 2025 and projected to rise to 7.0 in Q2 2025.

This highlights just how critical it is to create programs that foster both debt reduction and savings growth.

“We’re empowering people to resolve debt and build a secure future, recognizing the peace of mind that building savings brings.” –NFCC CEO Mike Croxson

How the Program Works

At the heart of the initiative is the pilot WealthBuilder savings component, developed in collaboration with FinTech partner Percapita. WealthBuilder enables participants to open goal-oriented savings accounts and provides tools to help them save consistently — even as they work on reducing their debt.

NFCC member agencies nationwide will participate in the pilot, representing a diverse cross-section of the population.

ICMM-Funded Research Will Inform the Future

The Institute of Consumer Money Management (ICMM) is proud to support the research component of this program, which is being conducted by the Center for Retirement Research at Boston College. The study will evaluate the pilot’s impact and generate insights into what works best for fostering savings habits and promoting long-term financial stability — particularly for individuals managing debt.

The findings are expected to inform not just NFCC’s future programs but also broader policies and practices that strengthen consumer financial resilience across the U.S.

Why It Matters

Life Beyond Debt is a bold step forward in tackling financial fragility at its root by addressing both sides of the equation: reducing debt and building a safety net. NFCC anticipates that the pilot program alone will help thousands of consumers make meaningful progress toward financial security and peace of mind.

For more about NFCC and their services, visit www.nfcc.org.